Date: Fri Feb 24 2006 - 22:35:33 EST

WebMD Wants to Go Beyond Information

By

<http://topics.nytimes.com/top/reference/timestopics/people/f/milt_freudenhe

im/index.html?inline=nyt-per> MILT FREUDENHEIM

Published: February 23, 2006

Marty Wygod, the entrepreneurial deal maker who built

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=HLTH> WebMD

Health into one of the most-visited medical information sites on the

Internet, is promoting the site as the next big thing in health care. Will

shareholders reap the benefits?

<http://www.nytimes.com/2006/02/23/business/23place.html?pagewanted=all#seco

ndParagraph>

<http://graphics8.nytimes.com/images/2006/02/23/business/place184.jpg>

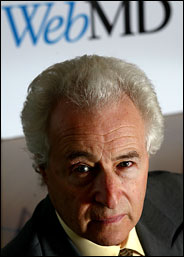

Jeff Zelevansky/Associated Press

Martin Wygod is chairman of WebMD, one of the most-visited medical

information Web sites.

By helping people enrolled in employer health plans compile personal health

information online, Mr. Wygod wants to tap into the growing corporate trend

of having employees pay more, if not all, of their own health costs. With

more of their own money at stake, the thinking goes, people need information

to help make decisions about health care.

WebMD says it has signed contracts with big health insurers and employers to

operate private-access sites where employees can keep track of their medical

records, look up information about diseases and compare costs and ratings

for doctors and hospitals. Employers or their insurers pay licensing fees to

WebMD, based on the services and number of health plan members.

Mr. Wygod's latest effort, which is still in the early stages, could be the

most visible test yet of whether the time has finally come for using the

Internet as much more than an online medical encyclopedia and health care

news medium.

"Corporate America is looking for a way to educate its employees about

health care costs, and hopefully to move a substantial amount of those costs

off their books," Mr. Wygod said in a telephone interview. But for investors

in WebMD Health, which will post its quarterly results today after the stock

market's close, the big question is how much of the potential upside might

be theirs to share. So far, they can hardly complain. In the four months

since the current iteration of the stock was issued at $17.50 - and closed

its first day of trading at $24.40 - the price has soared to a high of

$41.62 on Jan. 21, before slipping. Yesterday, it closed at $34.92, up 32

cents - still nearly double its initial price.

But only about 15 percent of WebMD Health is publicly held as a stand-alone

stock. The rest is owned by Emdeon, a holding company controlled by Mr.

Wygod that has been on a years-long acquisition spree. Emdeon, whose stock

languished for several years, has been buying back its shares and announced

last week that it was talking to prospective buyers for two of its main

businesses other than WebMD. On that news, Emdeon's stock has risen 15

percent over the last five trading days.

For a shareholder who might have invested in the original version of this

company - Healtheon, which went public in February 1999 as a venture of Jim

Clark, the Netscape founder - the road to the future has been a long,

winding path. Mr. Wygod, who sold his earlier venture, the pharmacy benefits

manager Medco Containment Services, to

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=MRK> Merck for $6

billion in 1993, said that when he took charge of Healtheon in 2000, it "was

losing $400 million in cash a quarter and was very close to bankruptcy."

Operating as Healtheon/WebMD, it acquired an office management system used

by thousands of doctors. That business was combined with the WebMD health

information and news site, as well as a widely used medical clearinghouse

for paying medical claims. It is those two non-WebMD Health businesses that

Emdeon now hopes to sell.

These days, two-thirds of WebMD Health's revenue comes from advertisers,

mainly drug companies and medical device makers, that buy ads on the

consumer site and on a separate service, <http://medscape.com/>

Medscape.com, a site where doctors can get treatment and diagnosis

information as well as additional medical education.

For WebMD's personalized information service, the company says it has signed

multiyear licensing contracts with big health insurers that include

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=AET> Aetna,

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=CI> Cigna and the

nation's largest, Wellpoint, and with nearly three dozen of the nation's

biggest employers, including

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=BAC> Bank of

America,

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=CSCO> Cisco

Systems,

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=DELL> Dell

Computer,

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=IBM> I.B.M.,

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=PFE> Pfizer,

Shell Oil and the state of North Carolina.

"The opportunity for WebMD is enormous," said Larry Feinberg, managing

partner of

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=ORCL> Oracle

Partners, a health care hedge fund. "It is so dominant in direct-to-consumer

and direct-to-doctor access that it will be very difficult for anyone else

on the Internet."

Under the personalized WebMD service, employees go to private Web sites to

fill out health status questionnaires. At some employers, like Pfizer and

Dell and North Carolina, employees use WebMD programs to combine the answers

with medical payment data from doctor visits and hospital stays to create

personal health histories. Employees receive reminders for periodic checkups

like mammograms, and online alerts about conditions that need early

attention - to stave off heart problems or diabetes, for example.

WebMD is also holding talks with banks and financial giants like Fidelity.

The banks view the trend to so-called consumer-directed health care as a

huge opportunity to manage tax-sheltered health savings accounts that many

workers are now being offered in tandem with low-premium, high-deductible

health insurance.

Christopher McFadden, a healthcare analyst at

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=GS> Goldman

Sachs, said he had concerns about the company's prospects. "WebMD is a

recognized brand name and it has a bit of a first-mover advantage," he said.

However, he said, the company "may be at risk from growing competition and

the prospects that more technology decisions are centered within hospital

networks, rather than physicians' offices."

Health care information technology specialists say that the personal health

profiles that WebMD creates, drawing on medical billing claims, are only an

interim step. Down the road, they say, are the oft-discussed databases of

detailed electronic medical records that the Bush administration and

Congress are promoting as a measure for patient safety and efficiency. Those

electronic records would include information like lab results, drug history

and a doctor's clinical notes on a patient's health, which would be

accessible online by doctors and hospital emergency rooms.

Companies much bigger than WebMD are vying for that market.

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=GE> General

Electric, for example, recently purchased IDX Systems, which provides

software for thousands of doctors' offices and hundreds of hospitals.

General Electric's Healthcare Integrated Information Technology unit sees an

opportunity to convert many patients' charts to electronic medical records,

said Vishal Wanchoo, president of the G.E. unit.

But in the nearer term, WebMD can point to its already close online

relationships with doctors. The idea of "the electronic medical record has

been around for 20 years," said Eric Brown, a vice president at

<http://www.nytimes.com/redirect/marketwatch/redirect.ctx?MW=http://custom.m

arketwatch.com/custom/nyt-com/html-companyprofile.asp&symb=FORR> Forrester

Research who follows health care information technology. But then as now, he

said, the time frame for this electronics record future always seems to be

"within the next five years."

When WebMD posts its financial results later today, analysts are expecting

quarterly earnings of 9 cents per share. What they are waiting to hear is

the company's guidance on the business prospects for Mr. Wygod's next big

thing.

http://www.nytimes.com/2006/02/23/business/23place.html